Financial Document OCR .NET

The .NET OCR SDK supports the Financial Document API.

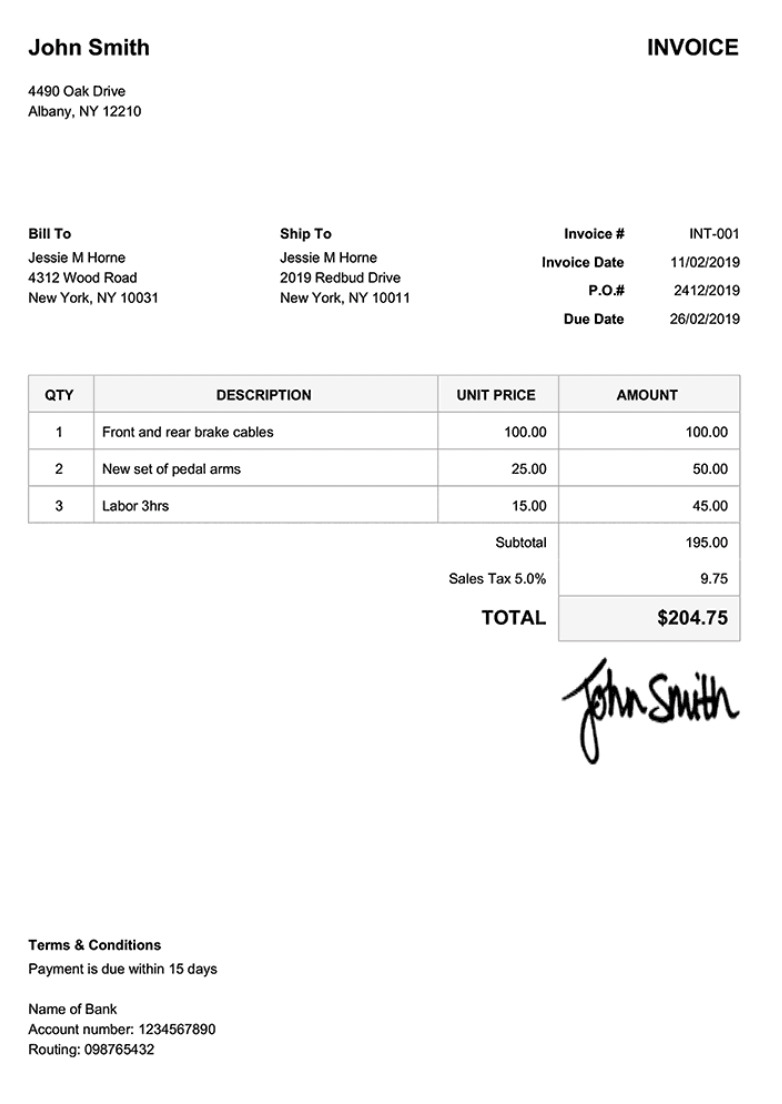

Using the sample below, we are going to illustrate how to extract the data that we want using the OCR SDK.

Quick-Start

using Mindee;

using Mindee.Input;

using Mindee.Product.FinancialDocument;

string apiKey = "my-api-key";

string filePath = "/path/to/the/file.ext";

// Construct a new client

MindeeClient mindeeClient = new MindeeClient(apiKey);

// Load an input source as a path string

// Other input types can be used, as mentioned in the docs

var inputSource = new LocalInputSource(filePath);

// Call the API and parse the input

var response = await mindeeClient

.ParseAsync<FinancialDocumentV1>(inputSource);

// Print a summary of all the predictions

System.Console.WriteLine(response.Document.ToString());

// Print only the document-level predictions

// System.Console.WriteLine(response.Document.Inference.Prediction.ToString());

You can also call this product asynchronously:

using Mindee;

using Mindee.Input;

using Mindee.Product.FinancialDocument;

string apiKey = "my-api-key";

string filePath = "/path/to/the/file.ext";

// Construct a new client

MindeeClient mindeeClient = new MindeeClient(apiKey);

// Load an input source as a path string

// Other input types can be used, as mentioned in the docs

var inputSource = new LocalInputSource(filePath);

// Call the product asynchronously with auto-polling

var response = await mindeeClient

.EnqueueAndParseAsync<FinancialDocumentV1>(inputSource);

// Print a summary of all the predictions

System.Console.WriteLine(response.Document.ToString());

// Print only the document-level predictions

// System.Console.WriteLine(response.Document.Inference.Prediction.ToString());

Output (RST):

########

Document

########

:Mindee ID: 6dd26385-719b-4527-bf6f-87d9da619de5

:Filename: default_sample.jpg

Inference

#########

:Product: mindee/financial_document v1.14

:Rotation applied: Yes

Prediction

==========

:Locale: en-US; en; US; USD;

:Invoice Number: INT-001

:Purchase Order Number: 2412/2019

:Receipt Number:

:Document Number: INT-001

:Reference Numbers: 2412/2019

:Purchase Date: 2019-11-02

:Due Date: 2019-11-17

:Payment Date: 2019-11-17

:Total Net: 195.00

:Total Amount: 204.75

:Taxes:

+---------------+--------+----------+---------------+

| Base | Code | Rate (%) | Amount |

+===============+========+==========+===============+

| 195.00 | | 5.00 | 9.75 |

+---------------+--------+----------+---------------+

:Supplier Payment Details:

:Supplier Name: JOHN SMITH

:Supplier Company Registrations:

:Supplier Address: 4490 Oak Drive Albany, NY 12210

:Supplier Phone Number:

:Customer Name: JESSIE M HORNE

:Supplier Website:

:Supplier Email:

:Customer Company Registrations:

:Customer Address: 2019 Redbud Drive New York, NY 10011

:Customer ID: 1234567890

:Shipping Address: 2019 Redbud Drive New York, NY 10011

:Billing Address: 4312 Wood Road New York, NY 10031

:Document Type: INVOICE

:Document Type Extended: INVOICE

:Purchase Subcategory:

:Purchase Category: miscellaneous

:Total Tax: 9.75

:Tip and Gratuity:

:Purchase Time:

:Line Items:

+--------------------------------------+--------------+----------+------------+--------------+--------------+-----------------+------------+

| Description | Product code | Quantity | Tax Amount | Tax Rate (%) | Total Amount | Unit of measure | Unit Price |

+======================================+==============+==========+============+==============+==============+=================+============+

| Front and rear brake cables | | 1.00 | | | 100.00 | | 100.00 |

+--------------------------------------+--------------+----------+------------+--------------+--------------+-----------------+------------+

| New set of pedal arms | | 2.00 | | | 50.00 | | 25.00 |

+--------------------------------------+--------------+----------+------------+--------------+--------------+-----------------+------------+

| Labor 3hrs | | 3.00 | | | 45.00 | | 15.00 |

+--------------------------------------+--------------+----------+------------+--------------+--------------+-----------------+------------+

Page Predictions

================

Page 0

------

:Locale: en-US; en; US; USD;

:Invoice Number: INT-001

:Purchase Order Number: 2412/2019

:Receipt Number:

:Document Number: INT-001

:Reference Numbers: 2412/2019

:Purchase Date: 2019-11-02

:Due Date: 2019-11-17

:Payment Date: 2019-11-17

:Total Net: 195.00

:Total Amount: 204.75

:Taxes:

+---------------+--------+----------+---------------+

| Base | Code | Rate (%) | Amount |

+===============+========+==========+===============+

| 195.00 | | 5.00 | 9.75 |

+---------------+--------+----------+---------------+

:Supplier Payment Details:

:Supplier Name: JOHN SMITH

:Supplier Company Registrations:

:Supplier Address: 4490 Oak Drive Albany, NY 12210

:Supplier Phone Number:

:Customer Name: JESSIE M HORNE

:Supplier Website:

:Supplier Email:

:Customer Company Registrations:

:Customer Address: 2019 Redbud Drive New York, NY 10011

:Customer ID: 1234567890

:Shipping Address: 2019 Redbud Drive New York, NY 10011

:Billing Address: 4312 Wood Road New York, NY 10031

:Document Type: INVOICE

:Document Type Extended: INVOICE

:Purchase Subcategory:

:Purchase Category: miscellaneous

:Total Tax: 9.75

:Tip and Gratuity:

:Purchase Time:

:Line Items:

+--------------------------------------+--------------+----------+------------+--------------+--------------+-----------------+------------+

| Description | Product code | Quantity | Tax Amount | Tax Rate (%) | Total Amount | Unit of measure | Unit Price |

+======================================+==============+==========+============+==============+==============+=================+============+

| Front and rear brake cables | | 1.00 | | | 100.00 | | 100.00 |

+--------------------------------------+--------------+----------+------------+--------------+--------------+-----------------+------------+

| New set of pedal arms | | 2.00 | | | 50.00 | | 25.00 |

+--------------------------------------+--------------+----------+------------+--------------+--------------+-----------------+------------+

| Labor 3hrs | | 3.00 | | | 45.00 | | 15.00 |

+--------------------------------------+--------------+----------+------------+--------------+--------------+-----------------+------------+

Field Types

Standard Fields

These fields are generic and used in several products.

BaseField

Each prediction object contains a set of fields that inherit from the generic BaseField class.

A typical BaseField object will have the following attributes:

- Confidence (

double?): the confidence score of the field prediction. - BoundingBox (

BoundingBox): contains exactly 4 relative vertices (points) coordinates of a right rectangle containing the field in the document. - Polygon (

Polygon): contains the relative vertices coordinates (PolygonextendsList<Point>) of a polygon containing the field in the image. - PageId (

int?): the ID of the page, alwaysnullwhen at document-level.

Note: A

Pointsimply refers to a List ofdouble.

Aside from the previous attributes, all basic fields have access to a custom ToString method that can be used to print their value as a string.

AddressField

Aside from the basic BaseField attributes, the address field AddressField also implements the following:

- StreetNumber (

string): String representation of the street number. Can benull. - StreetName (

string): Name of the street. Can benull. - PoBox (

string): String representation of the PO Box number. Can benull. - AddressComplement (

string): Address complement. Can benull. - City (

string): City name. Can benull. - Postalcode (

string): String representation of the postal code. Can benull. - State (

string): State name. Can benull. - Country (

string): Country name. Can benull.

Note: The Value field of an AddressField should be a concatenation of the rest of the values.

AmountField

An amount field AmountField extends BaseField, but also implements:

- Value (

double?): corresponds to the field value. Can benullif no value was extracted.

ClassificationField

The classification field ClassificationField extends BaseField, but also implements:

- Value (

strong): corresponds to the field value.

Note: a classification field's

value is always astring`.

CompanyRegistration

Aside from the basic BaseField attributes, the company registration field CompanyRegistration also implements the following:

- Type (

string): the type of company. - Value (

string): corresponds to the field value. - ToTableLine(): a method that formats the data to fit in a .rst display.

StringField

The text field StringField extends BaseField, but also implements:

- Value (

string): corresponds to the field value. - RawValue (

string): corresponds to the raw value as it appears on the document.

DateField

The date field DateField extends StringField, but also implements:

- DateObject (

DateTime?): an accessible representation of the value as a C# object. Can benull.

Locale

The locale field Locale extends BaseField, but also implements:

- Language (

string): ISO 639-1 language code (e.g.:enfor English). Can benull. - Country (

string): ISO 3166-1 alpha-2 or ISO 3166-1 alpha-3 code for countries (e.g.:GRBorGBfor "Great Britain"). Can benull. - Currency (

string): ISO 4217 code for currencies (e.g.:USDfor "US Dollars"). Can benull.

PaymentDetail

The payment details field PaymentDetail extends BaseField, but it also implements:

- AccountNumber (

string): number of an account, expressed as a string. Can benull. - Iban (

string): International Bank Account Number. Can benull. - RoutingNumber (

string): routing number of an account. Can benull. - Swift (

string): the account holder's bank's SWIFT Business Identifier Code (BIC). Can benull.

Taxes

Tax

Aside from the basic BaseField attributes, the tax field Tax also implements the following:

- Rate (

double?): the tax rate applied to an item expressed as a percentage. Can benull. - Code (

string): tax code (or equivalent, depending on the origin of the document). - Base (

double): base amount used for the tax. Can benull. - Value (

double): the value of the tax. Can benull.

Note: currently

Taxis not used on its own, and is accessed through a parentTaxesobject, a list-like structure.

Taxes (List)

The Taxes field represents a List of Tax objects. As it is the representation of several objects, it has access to a custom ToString method that can render a Tax object as a table line.

Specific Fields

Fields which are specific to this product; they are not used in any other product.

Line Items Field

List of line item present on the document.

A FinancialDocumentV1LineItem implements the following attributes:

- Description (

string): The item description. - ProductCode (

string): The product code referring to the item. - Quantity (

double): The item quantity - TaxAmount (

double): The item tax amount. - TaxRate (

double): The item tax rate in percentage. - TotalAmount (

double): The item total amount. - UnitMeasure (

string): The item unit of measure. - UnitPrice (

double): The item unit price.

Attributes

The following fields are extracted for Financial Document V1:

Billing Address

BillingAddress: The customer's address used for billing.

System.Console.WriteLine(result.Document.Inference.Prediction.BillingAddress.Value);

Purchase Category

Category: The purchase category.

Possible values include:

- 'toll'

- 'food'

- 'parking'

- 'transport'

- 'accommodation'

- 'gasoline'

- 'telecom'

- 'miscellaneous'

- 'software'

- 'shopping'

- 'energy'

System.Console.WriteLine(result.Document.Inference.Prediction.Category.Value);

Customer Address

CustomerAddress: The address of the customer.

System.Console.WriteLine(result.Document.Inference.Prediction.CustomerAddress.Value);

Customer Company Registrations

CustomerCompanyRegistrations: List of company registration numbers associated to the customer.

foreach (var CustomerCompanyRegistrationsElem in result.Document.Inference.Prediction.CustomerCompanyRegistrations)

{

System.Console.WriteLine(CustomerCompanyRegistrationsElem.Value);

}

Customer ID

CustomerId: The customer account number or identifier from the supplier.

System.Console.WriteLine(result.Document.Inference.Prediction.CustomerId.Value);

Customer Name

CustomerName: The name of the customer.

System.Console.WriteLine(result.Document.Inference.Prediction.CustomerName.Value);

Purchase Date

Date: The date the purchase was made.

System.Console.WriteLine(result.Document.Inference.Prediction.Date.Value);

Document Number

DocumentNumber: The document number or identifier (invoice number or receipt number).

System.Console.WriteLine(result.Document.Inference.Prediction.DocumentNumber.Value);

Document Type

DocumentType: The type of the document: INVOICE or CREDIT NOTE if it is an invoice, CREDIT CARD RECEIPT or EXPENSE RECEIPT if it is a receipt.

Possible values include:

- 'INVOICE'

- 'CREDIT NOTE'

- 'CREDIT CARD RECEIPT'

- 'EXPENSE RECEIPT'

System.Console.WriteLine(result.Document.Inference.Prediction.DocumentType.Value);

Document Type Extended

DocumentTypeExtended: Document type extended.

Possible values include:

- 'CREDIT NOTE'

- 'INVOICE'

- 'OTHER'

- 'OTHER_FINANCIAL'

- 'PAYSLIP'

- 'PURCHASE ORDER'

- 'QUOTE'

- 'RECEIPT'

- 'STATEMENT'

System.Console.WriteLine(result.Document.Inference.Prediction.DocumentTypeExtended.Value);

Due Date

DueDate: The date on which the payment is due.

System.Console.WriteLine(result.Document.Inference.Prediction.DueDate.Value);

Invoice Number

InvoiceNumber: The invoice number or identifier only if document is an invoice.

System.Console.WriteLine(result.Document.Inference.Prediction.InvoiceNumber.Value);

Line Items

LineItems(List<FinancialDocumentV1LineItem>): List of line item present on the document.

foreach (var LineItemsElem in result.Document.Inference.Prediction.LineItems)

{

System.Console.WriteLine(LineItemsElem.Value);

}

Locale

Locale: The locale of the document.

System.Console.WriteLine(result.Document.Inference.Prediction.Locale.Value);

Payment Date

PaymentDate: The date on which the payment is due / fullfilled.

System.Console.WriteLine(result.Document.Inference.Prediction.PaymentDate.Value);

Purchase Order Number

PoNumber: The purchase order number, only if the document is an invoice.

System.Console.WriteLine(result.Document.Inference.Prediction.PoNumber.Value);

Receipt Number

ReceiptNumber: The receipt number or identifier only if document is a receipt.

System.Console.WriteLine(result.Document.Inference.Prediction.ReceiptNumber.Value);

Reference Numbers

ReferenceNumbers: List of Reference numbers, including PO number, only if the document is an invoice.

foreach (var ReferenceNumbersElem in result.Document.Inference.Prediction.ReferenceNumbers)

{

System.Console.WriteLine(ReferenceNumbersElem.Value);

}

Shipping Address

ShippingAddress: The customer's address used for shipping.

System.Console.WriteLine(result.Document.Inference.Prediction.ShippingAddress.Value);

Purchase Subcategory

Subcategory: The purchase subcategory for transport, food and shooping.

Possible values include:

- 'plane'

- 'taxi'

- 'train'

- 'restaurant'

- 'shopping'

- 'other'

- 'groceries'

- 'cultural'

- 'electronics'

- 'office_supplies'

- 'micromobility'

- 'car_rental'

- 'public'

- 'delivery'

- null

System.Console.WriteLine(result.Document.Inference.Prediction.Subcategory.Value);

Supplier Address

SupplierAddress: The address of the supplier or merchant.

System.Console.WriteLine(result.Document.Inference.Prediction.SupplierAddress.Value);

Supplier Company Registrations

SupplierCompanyRegistrations: List of company registration numbers associated to the supplier.

foreach (var SupplierCompanyRegistrationsElem in result.Document.Inference.Prediction.SupplierCompanyRegistrations)

{

System.Console.WriteLine(SupplierCompanyRegistrationsElem.Value);

}

Supplier Email

SupplierEmail: The email of the supplier or merchant.

System.Console.WriteLine(result.Document.Inference.Prediction.SupplierEmail.Value);

Supplier Name

SupplierName: The name of the supplier or merchant.

System.Console.WriteLine(result.Document.Inference.Prediction.SupplierName.Value);

Supplier Payment Details

SupplierPaymentDetails: List of payment details associated to the supplier (only for invoices).

foreach (var SupplierPaymentDetailsElem in result.Document.Inference.Prediction.SupplierPaymentDetails)

{

System.Console.WriteLine(SupplierPaymentDetailsElem.Value);

}

Supplier Phone Number

SupplierPhoneNumber: The phone number of the supplier or merchant.

System.Console.WriteLine(result.Document.Inference.Prediction.SupplierPhoneNumber.Value);

Supplier Website

SupplierWebsite: The website URL of the supplier or merchant.

System.Console.WriteLine(result.Document.Inference.Prediction.SupplierWebsite.Value);

Taxes

Taxes: List of all taxes on the document.

foreach (var TaxesElem in result.Document.Inference.Prediction.Taxes)

{

System.Console.WriteLine(TaxesElem.Value);

}

Purchase Time

Time: The time the purchase was made (only for receipts).

System.Console.WriteLine(result.Document.Inference.Prediction.Time.Value);

Tip and Gratuity

Tip: The total amount of tip and gratuity

System.Console.WriteLine(result.Document.Inference.Prediction.Tip.Value);

Total Amount

TotalAmount: The total amount paid: includes taxes, tips, fees, and other charges.

System.Console.WriteLine(result.Document.Inference.Prediction.TotalAmount.Value);

Total Net

TotalNet: The net amount paid: does not include taxes, fees, and discounts.

System.Console.WriteLine(result.Document.Inference.Prediction.TotalNet.Value);

Total Tax

TotalTax: The sum of all taxes present on the document.

System.Console.WriteLine(result.Document.Inference.Prediction.TotalTax.Value);

Questions?

Updated 4 months ago