Invoice

The Ruby Client Library supports the Invoice API.

Product Specs

Specification Details Endpoint Name invoicesRecommended Version v4.11Supports Polling/Webhooks ✔️ Yes Support Synchronous HTTP Calls ✔️ Yes Geography 🌐 Global

Polling Limitations

Setting Parameter name Default Value Initial Delay Before Polling initial_delay_seconds2 seconds Default Delay Between Calls delay_sec1.5 seconds Polling Attempts Before Timeout max_retries80 retries

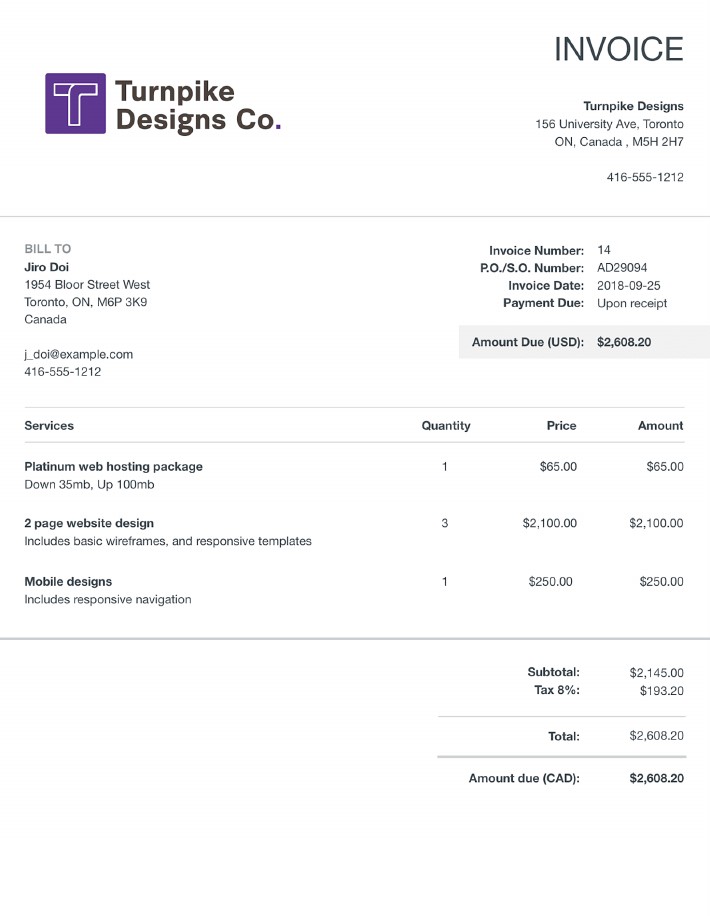

Using the sample below,

we are going to illustrate how to extract the data that we want using the Ruby Client Library.

Quick-Start

#

# Install the Ruby client library by running:

# gem install mindee

#

require 'mindee'

# Init a new client

mindee_client = Mindee::Client.new(api_key: 'my-api-key')

# Load a file from disk

input_source = mindee_client.source_from_path('/path/to/the/file.ext')

# Parse the file

result = mindee_client.parse(

input_source,

Mindee::Product::Invoice::InvoiceV4,

enqueue: false

)

# Print a full summary of the parsed data in RST format

puts result.document

# Print the document-level parsed data

# puts result.document.inference.prediction

You can also call this product asynchronously:

#

# Install the Ruby client library by running:

# gem install mindee

#

require 'mindee'

# Init a new client

mindee_client = Mindee::Client.new(api_key: 'my-api-key')

# Load a file from disk

input_source = mindee_client.source_from_path('/path/to/the/file.ext')

# Parse the file

result = mindee_client.parse(

input_source,

Mindee::Product::Invoice::InvoiceV4

)

# Print a full summary of the parsed data in RST format

puts result.document

# Print the document-level parsed data

# puts result.document.inference.prediction

Output (RST):

########

Document

########

:Mindee ID: 744748d5-9051-461c-b70c-bbf81f5ff943

:Filename: default_sample.jpg

Inference

#########

:Product: mindee/invoices v4.11

:Rotation applied: Yes

Prediction

==========

:Locale: en-CA; en; CA; CAD;

:Invoice Number: 14

:Purchase Order Number: AD29094

:Reference Numbers: AD29094

:Purchase Date: 2018-09-25

:Due Date:

:Payment Date:

:Total Net: 2145.00

:Total Amount: 2608.20

:Total Tax: 193.20

:Taxes:

+---------------+--------+----------+---------------+

| Base | Code | Rate (%) | Amount |

+===============+========+==========+===============+

| 2145.00 | | 8.00 | 193.20 |

+---------------+--------+----------+---------------+

:Supplier Payment Details:

:Supplier Name: TURNPIKE DESIGNS

:Supplier Company Registrations:

:Supplier Address: 156 University Ave, Toronto ON, Canada, M5H 2H7

:Supplier Phone Number: 4165551212

:Supplier Website:

:Supplier Email: [email protected]

:Customer Name: JIRO DOI

:Customer Company Registrations:

:Customer Address: 1954 Bloor Street West Toronto, ON, M6P 3K9 Canada

:Customer ID:

:Shipping Address:

:Billing Address: 1954 Bloor Street West Toronto, ON, M6P 3K9 Canada

:Document Type: INVOICE

:Document Type Extended: INVOICE

:Purchase Subcategory:

:Purchase Category: miscellaneous

:Line Items:

+--------------------------------------+--------------+----------+------------+--------------+--------------+-----------------+------------+

| Description | Product code | Quantity | Tax Amount | Tax Rate (%) | Total Amount | Unit of measure | Unit Price |

+======================================+==============+==========+============+==============+==============+=================+============+

| Platinum web hosting package Down... | | 1.00 | | | 65.00 | | 65.00 |

+--------------------------------------+--------------+----------+------------+--------------+--------------+-----------------+------------+

| 2 page website design Includes ba... | | 3.00 | | | 2100.00 | | 2100.00 |

+--------------------------------------+--------------+----------+------------+--------------+--------------+-----------------+------------+

| Mobile designs Includes responsiv... | | 1.00 | | | 250.00 | 1 | 250.00 |

+--------------------------------------+--------------+----------+------------+--------------+--------------+-----------------+------------+

Page Predictions

================

Page 0

------

:Locale: en-CA; en; CA; CAD;

:Invoice Number: 14

:Purchase Order Number: AD29094

:Reference Numbers: AD29094

:Purchase Date: 2018-09-25

:Due Date:

:Payment Date:

:Total Net: 2145.00

:Total Amount: 2608.20

:Total Tax: 193.20

:Taxes:

+---------------+--------+----------+---------------+

| Base | Code | Rate (%) | Amount |

+===============+========+==========+===============+

| 2145.00 | | 8.00 | 193.20 |

+---------------+--------+----------+---------------+

:Supplier Payment Details:

:Supplier Name: TURNPIKE DESIGNS

:Supplier Company Registrations:

:Supplier Address: 156 University Ave, Toronto ON, Canada, M5H 2H7

:Supplier Phone Number: 4165551212

:Supplier Website:

:Supplier Email: [email protected]

:Customer Name: JIRO DOI

:Customer Company Registrations:

:Customer Address: 1954 Bloor Street West Toronto, ON, M6P 3K9 Canada

:Customer ID:

:Shipping Address:

:Billing Address: 1954 Bloor Street West Toronto, ON, M6P 3K9 Canada

:Document Type: INVOICE

:Document Type Extended: INVOICE

:Purchase Subcategory:

:Purchase Category: miscellaneous

:Line Items:

+--------------------------------------+--------------+----------+------------+--------------+--------------+-----------------+------------+

| Description | Product code | Quantity | Tax Amount | Tax Rate (%) | Total Amount | Unit of measure | Unit Price |

+======================================+==============+==========+============+==============+==============+=================+============+

| Platinum web hosting package Down... | | 1.00 | | | 65.00 | | 65.00 |

+--------------------------------------+--------------+----------+------------+--------------+--------------+-----------------+------------+

| 2 page website design Includes ba... | | 3.00 | | | 2100.00 | | 2100.00 |

+--------------------------------------+--------------+----------+------------+--------------+--------------+-----------------+------------+

| Mobile designs Includes responsiv... | | 1.00 | | | 250.00 | 1 | 250.00 |

+--------------------------------------+--------------+----------+------------+--------------+--------------+-----------------+------------+

Field Types

Standard Fields

These fields are generic and used in several products.

Basic Field

Each prediction object contains a set of fields that inherit from the generic Field class.

A typical Field object will have the following attributes:

- value (

String,Float,Integer,bool): corresponds to the field value. Can benilif no value was extracted. - confidence (Float, nil): the confidence score of the field prediction.

- bounding_box (

Mindee::Geometry::Quadrilateral,nil): contains exactly 4 relative vertices (points) coordinates of a right rectangle containing the field in the document. - polygon (

Mindee::Geometry::Polygon,nil): contains the relative vertices coordinates (Point) of a polygon containing the field in the image. - page_id (

Integer,nil): the ID of the page, alwaysnilwhen at document-level. - reconstructed (

bool): indicates whether an object was reconstructed (not extracted as the API gave it).

Aside from the previous attributes, all basic fields have access to a to_s method that can be used to print their value as a string.

AddressField

Aside from the basic BaseField attributes, the address field AddressField also implements the following:

- street_number (

String): String representation of the street number. Can benil. - street_name (

String): Name of the street. Can benil. - po_box (

String): String representation of the PO Box number. Can benil. - address_complement (

String): Address complement. Can benil. - city (

String): City name. Can benil. - postal_code (

String): String representation of the postal code. Can benil. - state (

String): State name. Can benil. - country (

String): Country name. Can benil.

Note: The value field of an AddressField should be a concatenation of the rest of the values.

Amount Field

The amount field AmountField only has one constraint: its value is a Float (or nil).

Classification Field

The classification field ClassificationField does not implement all the basic Field attributes. It only implements

value, confidence and page_id.

Note: a classification field's

value is always aString`.

Company Registration Field

Aside from the basic Field attributes, the company registration field CompanyRegistrationField also implements the

following:

- type (

String): the type of company.

Date Field

Aside from the basic Field attributes, the date field DateField also implements the following:

- date_object (

Date): an accessible representation of the value as a JavaScript object.

Locale Field

The locale field LocaleField only implements the value, confidence and page_id base Field attributes,

but it comes with its own:

- language (

String): ISO 639-1 language code (e.g.:enfor English). Can benil. - country (

String): ISO 3166-1 alpha-2 or ISO 3166-1 alpha-3 code for countries (e.g.:GRBorGBfor "Great

Britain"). Can benil. - currency (

String): ISO 4217 code for currencies (e.g.:USDfor "US Dollars"). Can benil.

Payment Details Field

Aside from the basic Field attributes, the payment details field PaymentDetailsField also implements the

following:

- account_number (

String): number of an account, expressed as a string. Can benil. - iban (

String): International Bank Account Number. Can benil. - routing_number (

String): routing number of an account. Can benil. - swift (

String): the account holder's bank's SWIFT Business Identifier Code (BIC). Can benil.

String Field

The text field StringField only has one constraint: it's value is a String (or nil).

Taxes Field

Tax

Aside from the basic Field attributes, the tax field TaxField also implements the following:

- rate (

Float): the tax rate applied to an item can be expressed as a percentage. Can benil. - code (

String): tax code (or equivalent, depending on the origin of the document). Can benil. - base (

Float): base amount used for the tax. Can benil. - value (

Float): the value of the tax. Can benil.

Note: currently

TaxFieldis not used on its own, and is accessed through a parentTaxesobject, an array-like

structure.

Taxes (Array)

The Taxes field represents an array-like collection of TaxField objects. As it is the representation of several

objects, it has access to a custom to_s method that can render a TaxField object as a table line.

Specific Fields

Fields which are specific to this product; they are not used in any other product.

Line Items Field

List of all the line items present on the invoice.

A InvoiceV4LineItem implements the following attributes:

description(String): The item description.product_code(String): The product code of the item.quantity(Float): The item quantitytax_amount(Float): The item tax amount.tax_rate(Float): The item tax rate in percentage.total_amount(Float): The item total amount.unit_measure(String): The item unit of measure.unit_price(Float): The item unit price.

Attributes

The following fields are extracted for Invoice V4:

Billing Address

billing_address (AddressField): The customer billing address.

puts result.document.inference.prediction.billing_address.value

Purchase Category

category (ClassificationField): The purchase category.

Possible values include:

- 'toll'

- 'food'

- 'parking'

- 'transport'

- 'accommodation'

- 'telecom'

- 'miscellaneous'

- 'software'

- 'shopping'

- 'energy'

puts result.document.inference.prediction.category.value

Customer Address

customer_address (AddressField): The address of the customer.

puts result.document.inference.prediction.customer_address.value

Customer Company Registrations

customer_company_registrations (Array<CompanyRegistrationField>): List of company registration numbers associated to the customer.

result.document.inference.prediction.customer_company_registrations do |customer_company_registrations_elem|

puts customer_company_registrations_elem.value

end

Customer ID

customer_id (StringField): The customer account number or identifier from the supplier.

puts result.document.inference.prediction.customer_id.value

Customer Name

customer_name (StringField): The name of the customer or client.

puts result.document.inference.prediction.customer_name.value

Purchase Date

date (DateField): The date the purchase was made.

puts result.document.inference.prediction.date.value

Document Type

document_type (ClassificationField): Document type: INVOICE or CREDIT NOTE.

Possible values include:

- 'INVOICE'

- 'CREDIT NOTE'

puts result.document.inference.prediction.document_type.value

Document Type Extended

document_type_extended (ClassificationField): Document type extended.

Possible values include:

- 'CREDIT NOTE'

- 'INVOICE'

- 'OTHER'

- 'OTHER_FINANCIAL'

- 'PAYSLIP'

- 'PURCHASE ORDER'

- 'QUOTE'

- 'RECEIPT'

- 'STATEMENT'

puts result.document.inference.prediction.document_type_extended.value

Due Date

due_date (DateField): The date on which the payment is due.

puts result.document.inference.prediction.due_date.value

Invoice Number

invoice_number (StringField): The invoice number or identifier.

puts result.document.inference.prediction.invoice_number.value

Line Items

line_items (Array<InvoiceV4LineItem>): List of all the line items present on the invoice.

result.document.inference.prediction.line_items do |line_items_elem|

puts line_items_elem.value

end

Locale

locale (LocaleField): The locale of the document.

puts result.document.inference.prediction.locale.value

Payment Date

payment_date (DateField): The date on which the payment is due / was full-filled.

puts result.document.inference.prediction.payment_date.value

Purchase Order Number

po_number (StringField): The purchase order number.

puts result.document.inference.prediction.po_number.value

Reference Numbers

reference_numbers (Array<StringField>): List of all reference numbers on the invoice, including the purchase order number.

result.document.inference.prediction.reference_numbers do |reference_numbers_elem|

puts reference_numbers_elem.value

end

Shipping Address

shipping_address (AddressField): Customer's delivery address.

puts result.document.inference.prediction.shipping_address.value

Purchase Subcategory

subcategory (ClassificationField): The purchase subcategory for transport, food and shopping.

Possible values include:

- 'plane'

- 'taxi'

- 'train'

- 'restaurant'

- 'shopping'

- 'other'

- 'groceries'

- 'cultural'

- 'electronics'

- 'office_supplies'

- 'micromobility'

- 'car_rental'

- 'public'

- 'delivery'

- nil

puts result.document.inference.prediction.subcategory.value

Supplier Address

supplier_address (AddressField): The address of the supplier or merchant.

puts result.document.inference.prediction.supplier_address.value

Supplier Company Registrations

supplier_company_registrations (Array<CompanyRegistrationField>): List of company registration numbers associated to the supplier.

result.document.inference.prediction.supplier_company_registrations do |supplier_company_registrations_elem|

puts supplier_company_registrations_elem.value

end

Supplier Email

supplier_email (StringField): The email address of the supplier or merchant.

puts result.document.inference.prediction.supplier_email.value

Supplier Name

supplier_name (StringField): The name of the supplier or merchant.

puts result.document.inference.prediction.supplier_name.value

Supplier Payment Details

supplier_payment_details (Array<PaymentDetailsField>): List of payment details associated to the supplier of the invoice.

result.document.inference.prediction.supplier_payment_details do |supplier_payment_details_elem|

puts supplier_payment_details_elem.value

puts supplier_payment_details_elem.rate

puts supplier_payment_details_elem.code

puts supplier_payment_details_elem.basis

end

Supplier Phone Number

supplier_phone_number (StringField): The phone number of the supplier or merchant.

puts result.document.inference.prediction.supplier_phone_number.value

Supplier Website

supplier_website (StringField): The website URL of the supplier or merchant.

puts result.document.inference.prediction.supplier_website.value

Taxes

taxes (Array<TaxField>): List of taxes. Each item contains the detail of the tax.

result.document.inference.prediction.taxes do |taxes_elem|

puts taxes_elem.value

end

Total Amount

total_amount (AmountField): The total amount of the invoice: includes taxes, tips, fees, and other charges.

puts result.document.inference.prediction.total_amount.value

Total Net

total_net (AmountField): The net amount of the invoice: does not include taxes, fees, and discounts.

puts result.document.inference.prediction.total_net.value

Total Tax

total_tax (AmountField): The total tax: the sum of all the taxes for this invoice.

puts result.document.inference.prediction.total_tax.value

Questions?

Updated 4 months ago